BUSINESS MODEL

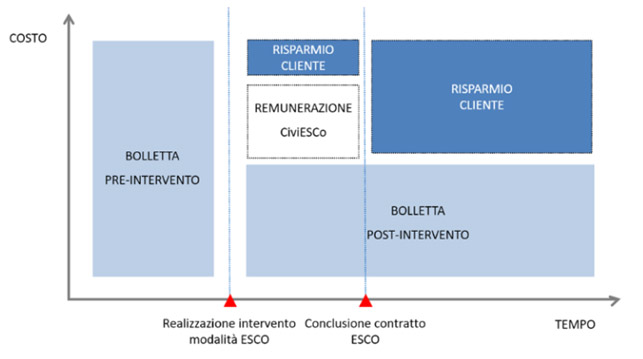

The primary objective of the project finance interventions proposed by CiviESCo is to generate guaranteed savings for its customers, with a remuneration based on the results obtained and objectively measured in terms of energy consumption.

Other strategic areas in which we are committed to efficiency and innovation are:

Changing does not always mean improving, but to improve we must change.

Buy a good on credit or pay a service fee?

In the first case the company, in the face of a need, makes an economic assessment of the costs, benefits and sustainability of the investment and decides to buy an asset. The company must identify the priorities of the interventions on the basis of an energy audit and establish a time schedule of the same. Resources are concentrated on production / marketing, maintaining a sustainable financial profile even in periods of negative economic conditions. The company is covered by investments, management costs and insurance with part of the savings.

In the case of payment of a fee instead, a financial analysis of the investment is made annually, assessing its impact on its capital ratios and determining a rate for the loan. The ESCo provides for the energy audit, analysis and design, to finance the operation, to supply systems / installation, to stipulate adequate insurance coverage, to optimize the contributions linked to efficiency. The fee is formed by the savings obtained: the ESCo monitors the system and the results and pays the penalties in the event of not achieving the guaranteed minimum savings.

The convenience between the two modes depends on a series of factors, such as the type of activity practiced, the technological "maturity" of the good / service, the level of financial debt, the state of the art of regulation.